August 8, 2016

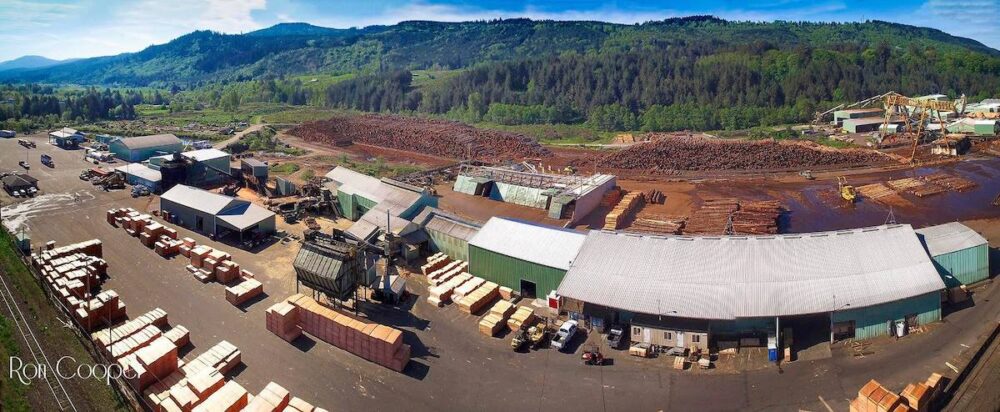

Changes in the wood product market produce individual challenges for Freres Lumber Company in the veneer, plywood, and lumber sectors.

Veneer

There is curretly more veneer production than can be supported, which is not generally a good sign. That said the veneer being produced is not the veneer that is needed in the market. The fundamental problem for west coast veneer based product markets is that there is not enough product diversification to promote an energetic exchange of various veneer grades; the panel market is too specialized into specific producers using specific grades. While the veneer market is still large and growing with the overall housing market, certain grades suffer because panel producers grab for seemingly easy to produce items while neglecting higher margin items due to perceived complexity of production. Until producers figure out where the highest margins are, we will experience a very transitional time in veneer products markets with considerable turmoil.

Veneer plants have started to target the Laminated Veneer Lumber (LVL) market with the idea that yields are better for veneer than the end product. LVL is manufactured using a very specific grade of veneer and requires not only foresight in regards to the type of log purchased but also to the producer you are marketing to. If you build it, the market will not necessarily come. You still need to be able to market all other grades that come from every log and there is no log that yields exactly what you want. Every sector of the panel markets such as hardwood, specialty, and CDX panel production must have decent strength for there to be a robust veneer market.

Hardwood panel production is suffering from the same malaise that most US panel production suffers from; imports. The Chinese can still purchase our logs, ship them to China, manufacture them into finished products, and ship them back to the US as finished goods at dramatically cheaper prices than domestic producers can support. That is impossible without direct subsidy or currency subsidy in my opinion.

High-grade panels, such as HDO and MDO panels, are experiencing strong demand due to the announced closure of Plum Creek’s Columbia Falls facility and the recent closure of Olympic’s Shelton facility. While Weyerhaeuser claims that they will absorb all potential sales opportunities from Columbia Fall’s closure at their Kalispell facility, there is no current replacement for the production lost at Shelton. Most MDO and HDO producers are running at capacity.

Plywood

The CDX plywood market has been much stronger over the last month due to the US housing market overcoming the downside pressure of increased imports. We still have an order file and are fielding decent inquiries, but sales volume has been lighter over the last couple of weeks. We believe there will be another buying round before the end of the month and most panel producers are optimistic as we approach the fall market.

Lumber

For those who keep track of wood products news, the Softwood Lumber Agreement, which is being renegotiated as we speak, is a trade agreement between Canada and the US based solely upon a specific finished product; lumber. While lumber producers might receive additional protections from such an agreement, all other wood products will suffer. We use the same raw material lumber producers use, logs. The omission of veneer-based products in the agreement puts us at a severe disadvantage to domestic lumber producers. The end result is that lumber producers are protected while domestic veneer and panel producers battle the markets against Canadian producers who get a built in 30% currency exchange advantage. It makes for a tough battle and explains why we have lost panel producers in the Northwest US.

Freres Lumber Company is well positioned to take advantage of a stronger plywood and LVL market. There is going to be some friction with specific veneer grades, but on a whole we expect the market to improve with increased housing starts. We anticipate a five-day production schedule through August at the veneer plants due to project schedules but we will try to run harder when we have the flexibility. The plywood plant will continue to run Saturdays while the markets are stronger.

Subscribe

We’ll send you a notification when a new story has been posted. It’s the easiest way to stay in the know.