October 15, 2018

Depressed Markets Across the Wood Products Spectrum

Wood products market dropped dramatically over the last couple of weeks, extending price discounts from earlier in the month. Panel markets are looking for a bottom, with few customers willing to commit to a firm number. Random Lengths price indexes indicate plywood panel prices have dropped over 20% since the highs of the summer. Lumber has had an even tougher experience with price declines approaching 50% from highs for some products. Log prices, while stubbornly high through the year, have only now begun to show price declines for open market logs. Veneer has been the most price stable of any of the wood products, primarily due to short term market dynamics. While veneer has just begun to correct, it is declining at a much slower pace than finished product prices. There is little indication that there will be a rapid veneer correction providing any relief for finished product producers.

Foreign Imports Affecting Market

What gives? The macro-economic numbers are solid. The unemployment rate just hit 3.7%, a number that the US hasn’t seen for 50 years. GDP growth is projected to be 3.9% in the 4th quarter. Home prices are at record levels and inventories are low. All in all, we are in the middle of a United States Cinderella Story!

US plywood consumption is up 10.8% in 2018, but US plywood production increased only 1.2%. World trade is having an over weighted effect on wood products markets. Imports of Chinese softwood panels have increased 700% and imports of Brazilian softwood panels increased by 36%, and this is only by July! There are some rumors that Chinese panels may be hit with additional duties due to circumventing the ITC hardwood panel ruling from last year which imposed punitive duties of around 200% on some Chinese panels. Time will tell if that is true.

No Current Changes to the Softwood Lumber Agreement

NAFTA 2.0, the United States-Mexico-Canada-Agreement, was ultimately silent regarding softwood product imports. While the agreement encompasses autos, dairies, intellectual property, and a host of other industries, the Softwood Lumber Agreement, the largest point of contention between the US and Canada over the years, was not part of the agreement. It appears that future issues regarding the SLA will be hammered out separately.

Product price declines like this are extremely dangerous times for US producers. Most producers take in a mix of private, public and open market logs. Each seller has a different time frame for price commitment by contract, with the highest quality and longest contracts being the Federal and State sales. There will be some very high-priced sales that must be choked down in the short-term by most of the producers in the West Coast.

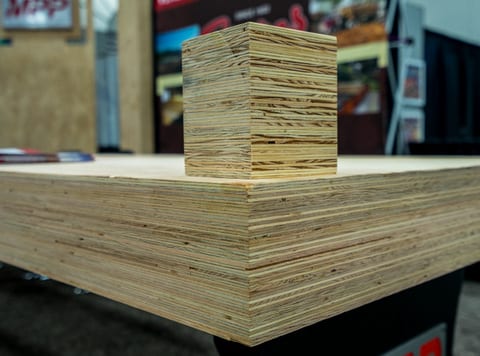

Mass Ply Panels to Become Part of OSU’s New Peavy Hall

The first structural panels have shipped from Plant 6 to Oregon State University’s Peavy Hall and Advanced Wood Products Facility! These shipments occurred only two months after receiving structural certification with the APA.

If you would like to see the panels in action, Oregon State has a webcam of the progress at http://webcam.oregonstate.edu/. The webcams for the Forest Science Building show the panels.

Congratulations and thank you to the team at Plant 6!

Subscribe

We’ll send you a notification when a new story has been posted. It’s the easiest way to stay in the know.